IS Ratings for Asset Owners and Borrowers

IS ratings can support infrastructure asset owners and borrowers in preparing their ESG reports and in securing preferential financing through third-party assured ESG performance and data.

IS Ratings for ESG reporting

Stakeholders and regulators increasingly expect organisations to report on their social, environmental and governance performance. ESG reporting is becoming a minimum requirement and organisations need the right tools to monitor and report on key sustainability metrics.

IS Ratings can help provide assurance for ESG performance and data on an asset level.

Data that are provided as part of an IS rating include metrics on:

- Greenhouse gas emissions & reductions including embodied emissions for materials

- Waste volumes and diversion from landfill

- Materials use, including use of certified sustainable materials

- Water use, including alternative source substitution

- Community, health & well-being and safety data

- Risk & opportunity metrics including climate risk, natural hazards & resilience

- Ecological impacts

As such, IS Ratings certify outcomes and can help set up processes and generate data which feed into existing and emerging ESG/Sustainability reporting requirements such as TCFD, TNFD, ISSB.

IS Ratings for Sustainable Finance

The value and proportion of “responsible investment” assets in the total market are growing rapidly. Green and sustainable financing products come in many forms and include sustainability-linked loans, green loans, social loans and green bonds. These products enable borrowers to signal their ESG commitments to external stakeholders and to access financial incentives for achieving sustainability objectives.

IS ratings can support borrowers and owners in securing preferential financing for infrastructure assets through third party assured sustainability performance and data.

How do sustainable finance products work?

Green loans or Sustainability Linked Loans (SLLs) typically contain these core components:

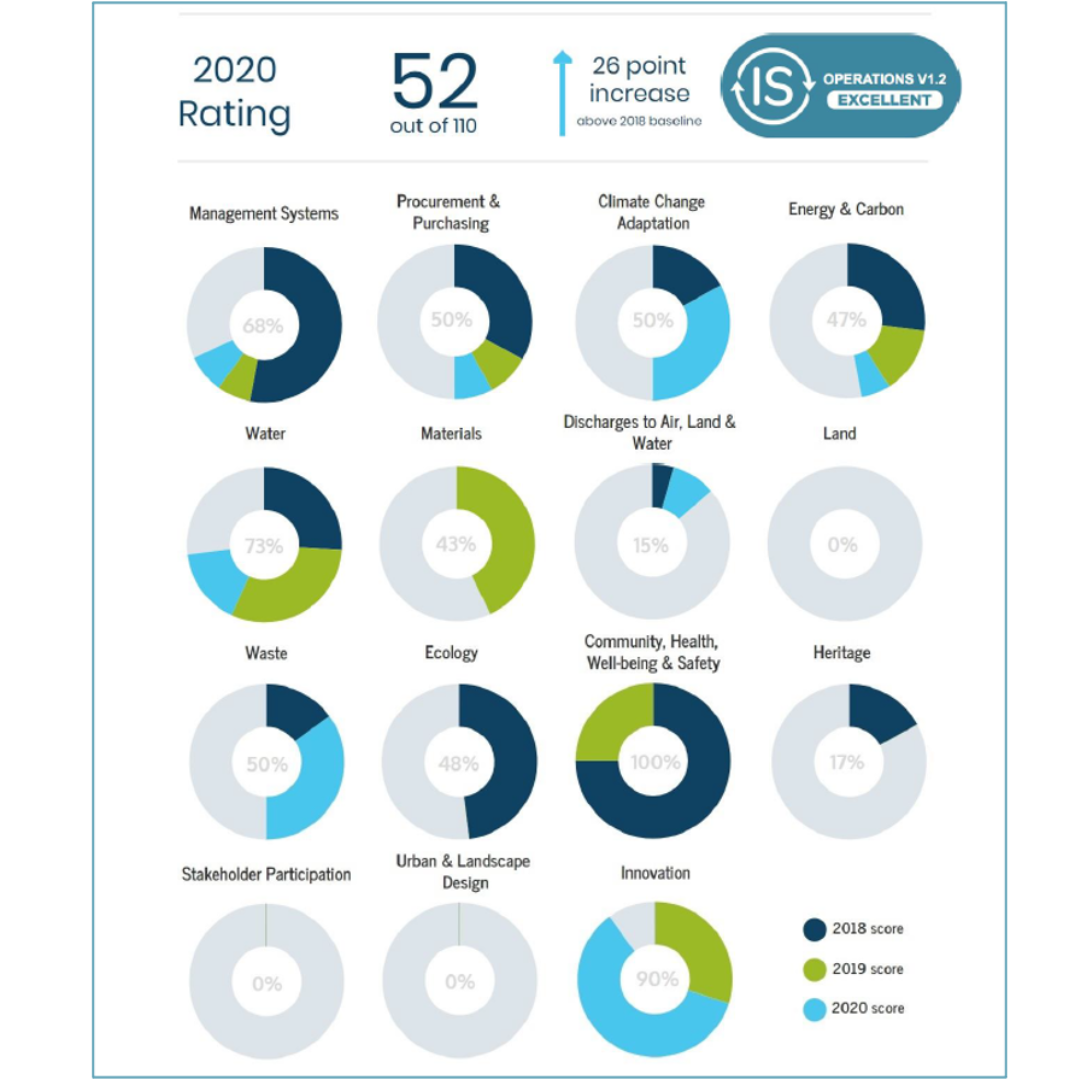

- Sustainability KPIs – set of measurable metrics that are material to the asset

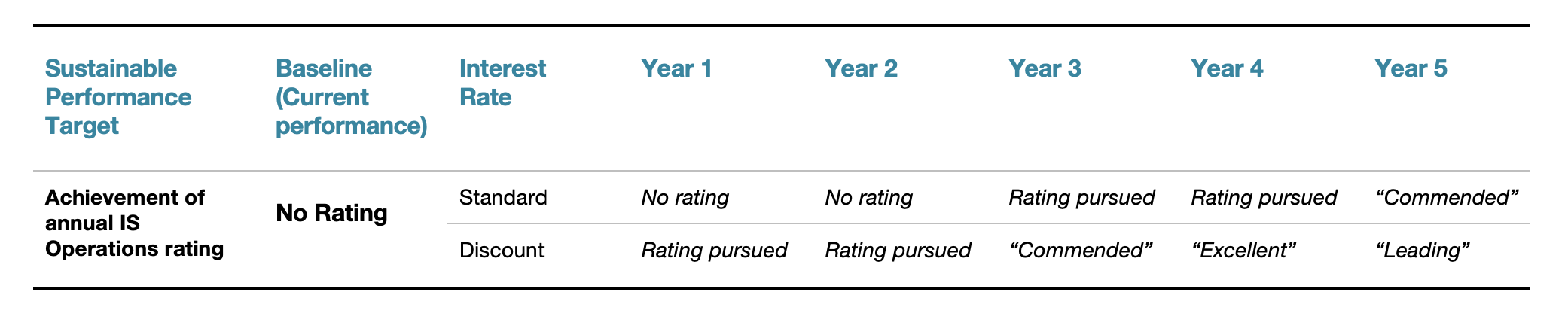

- Sustainability Performance Targets (SPT)s that the parties agree on

- Loan Characteristics that link conditions (e.g. interest rates) to the meeting of SPTs

- Reporting requirements against the progress on the SPT

- Verification requirements, e.g. via external auditors or assurance providers

How can IS Ratings be used in Green loans or Sustainability Linked Loans (SLLs) for infrastructure assets?

- IS Ratings through the materiality assessments help identify the Sustainability KPIs that are the most material to the asset.

- IS Ratings provide a benchmarking of the asset’s sustainability performance of key metrics against Business-As-Usual approach

- IS Ratings enable ongoing performance monitoring of the asset’s key metrics (IS Operations tool)

- IS Ratings provide independent third-party assurance for KPIs and SPT

IS ratings are available across planning,

- Design

- Construction and

- Operations phase of an infrastructure asset

- Projects

- Programs and, from there

- Portfolios